March 28, 2021

First, a review of last week’s events:

- EUR/USD. The dollar has periodically changed its status since the COVID-19 pandemic started, becoming either a safe haven currency or a risky asset for investors. For example, the US currency declined amid rising stock markets in November-December 2020. And since January, the dollar began to rise along with the S&P500. Now this index is in the area of its all-time high: 3.795. The DXY dollar index is also quoted in the area of annual highs: 92.72.

The main reason for this volatility in the USD is the coronavirus situation and the US government's response to it. And the Fed threw in yet another riddle last week. Recall that it has become clear following the meeting of the Open Market Committee (FOMC) that the US Federal Reserve does not intend to raise interest rates until at least 2023. The Fed is not going to change other parameters of the quantitative easing (QE) program either. The bill signed by US President Joe Biden on a new $1.9 trillion package, according to the Fed, is quite a sufficient measure to stimulate the economy.

Just a few days later, Fed Chairman Jerome Powell announced that the regulator would gradually phase out $120 billion in monthly asset purchases from the moment the US economy almost fully recovers. And this, according to forecasts of the Fed itself could happen this summer.

So, it turns out that the Government and the Senate may start a debate on winding down QE in the near future. But what about the information that the Biden Administration is now discussing another new package of fiscal stimulus for another $3.0 trillion?

The market "sided" with Jerome Powell this time, and the dollar continued to strengthen its positions. As predicted by the main forecast, which was voted for by the majority of analysts (65%), the EUR/USD pair went down, broke through the support at the 200-day SMA at 1.1825, and dropped to the 1.1760 horizon. This was followed by a slight rebound and a finish at 1.1790;

- GBP/USD. After a two-week stay in the sideways channel 1.3775-1.4000, the widespread strengthening dollar pulled the pair down. 55% of the experts were on the side of the bears, and they were right. The GBP/USD pair reached the local bottom at 1.3670 on Thursday, March 25, after which it returned to the lower border of the side channel, which turned from support to resistance. The last chord of the week sounded near it, at the level of 1.3790;

- USD/JPY. The large-scale correction of the pair to the south never happened. Just 50 points were enough for the pair: having dropped to the level of 108.40, it turned around and went north again, following the strengthening dollar. The nearest target of the bulls was designated the height of 110.00, and the pair almost reached it: the week's high was fixed at 109.85. After that, it declined slightly and completed the working five days at 109.67;

- cryptocurrencies. The forecast for the past week, which was supported by the majority of experts, was not most optimistic for the bulls. It assumed the cessation of growth, the breakdown of bitcoin's lower boundary of the upward channel and its lateral movement in the range of $50,000-60,000. Unfortunately for investors, this is exactly what happened. The BTC/USD pair was at a height of $60,000 on March 20, but it found a local bottom at around $50,290 on Thursday March 25. And if the fall in bitcoin was 16%, then some of the top altcoins lost about 25% in price.

One of the few that won was ripple. Starting at $0.4652 seven days before, it peaked at $0.5955 on March 22, and was trading at $0.5450 by the evening of Friday March 26.

In general, as we predicted, the crypto market turned out to be overheated. Elon Musk's statement that bitcoins accepted as payment for Tesla cars would no longer be converted into dollars did not help it either. such information could have pushed the market high up not so long ago, but now it has given only a small short-term impulse.

According to Skybridge Capital CEO and former White House communications director Anthony Scaramucci, Tesla has about $1.5 billion in BTC at the moment. In total, Elon Musk owns little more than $5 billion in bitcoins through Tesla, SpaceX and personally. Perhaps this is no longer enough, and bitcoin needs more powerful locomotives than Tesla or MicroStrategy to move the market up.

But just a few words from regulators such as the US Fed are enough to push it down. The head of the US Federal Reserve System Jerome Powell questioned the qualities of the first cryptocurrency as a tool for savings and payments. During his speech at the virtual summit of the Bank for International Settlements, he noted the high volatility of digital assets, because of which, in his opinion, they are useless as a means of accumulation. “They are not backed by anything and are used more for speculation, so they are not particularly popular as a means of payment. Crypto assets are more likely to replace gold rather than the dollar,” Powell said.

The fall of BTC/USD was evidently affected by the fall of the S&P500, with which such a risk asset as “digital gold” correlates more and more. Traders have closed about 240,000 positions over the past few days, and the total capitalization of the crypto market has decreased from $1805 billion to $1,680 billion. The Crypto Fear & Greed Index moved from 71 to the central zone during the week and is at 54, which is flat. However, it is possible that this is only a lull before the storm.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. There are three main factors on the side of the American currency. The first is the successful vaccination of the population, including not only the results already achieved, but also the promise of President Biden to vaccinate 200 million US residents in the first 100 days of his stay in the White House. The second factor is the growing attractiveness of government bonds for foreign investors. And the third factor is the strength of the US economy, which is capable of lifting the economies of many other countries along with itself.

Europe has none of these factors. ECB Vice President Luis de Guindos did say that if vaccination in the Eurozone increases sharply by the summer, then Europe will face a sharp economic rise in Q3 and Q4. But these are just words.

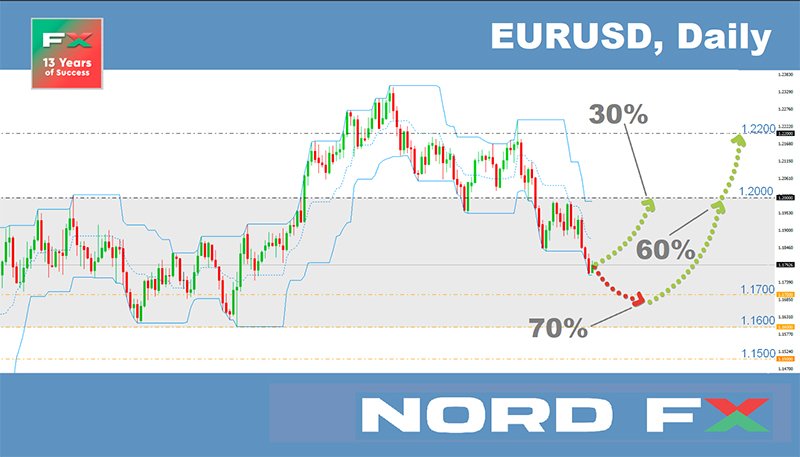

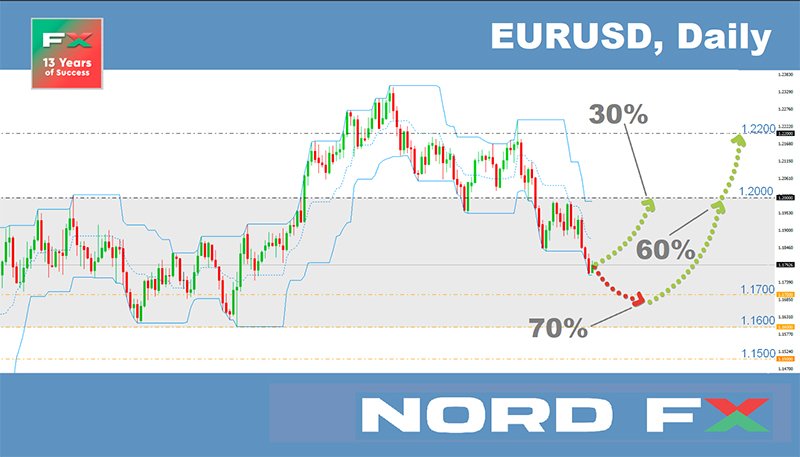

At the moment, 70% of experts expect the dollar to continue strengthening and the EUR/USD pair to decline to the 1.1640-1.1700 zone. The ultimate target is the lows of September-November 2020 around 1.1600. This forecast is supported by 85% of trend indicators on H4 and 100% on D1, as well as 75% of oscillators on D1. The remaining 25% give signals that the pair is oversold.

Note that graphical analysis indicates that the euro may strengthen to 1.1880 in the coming days on both time frames, and the pair will go south only after that.

It should also be noted that when switching from a weekly to a monthly forecast, it is already 60% of analysts who vote for the growth of the EUR/USD pair. The targets are 1.2000 and 1.2200.

As for the events of the coming week, the release of data on the consumer markets in Germany on March 30 and the Eurozone on March 31 should be considered, as well as data on the US labor market on Wednesday March 31 (ADP report) and Friday April 02 (NFP). The speech of U.S. President Joe Biden on March 31 is also of interest. Markets will wait for signals from him regarding the steps that his administration will take to speed up the recovery of the country's economy;

- GBP/USD. We will receive UK GDP data for Q4 2020 on Wednesday, the last day of March. According to forecasts, the indicator will remain at the previous level of 1%. This is unlikely to add optimism to investors, but it will not upset them either. Therefore, 50% of them vote for the sideways trend, 40% for the strengthening of the dollar and only 10% for the strengthening of the British pound.

The technical analysis readings are as follows. On H4: 50% of the oscillators point to the north, 50% to the south. The trend indicators have a similar pattern. D1 is dominated by red. 65% of oscillators and 70% of trend indicators are colored red.

The nearest support levels are 1.3760, 1.3700, 1.3670, resistance levels are 1.3820, 1.3900, 1.3960. The targets are 1.4000 and 1.3600, respectively;

- USD/JPY. The pair reached a nine-month high at 109.85 last week, showing an impressive increase of almost 730 points over the past three months. This suggests that such traditional safe havens, which is the yen, are now of little interest to investors.

It is unlikely that the Tankan index will greatly affect the market sentiment. Published by the Bank of Japan, this index reflects general business conditions for large manufacturing companies. Tankan is an economic indicator of Japan, which is heavily dependent on export-oriented industry. The index value above 0 is positive for the yen, the value below 0, respectively, is a negative factor. However, according to forecasts, the value of the index, which will be published on Thursday April 01, will not be higher or lower, but equal to 0. This is a neutral value. Although, it is possible that it will support the Japanese currency somewhat, since Tankan was at minus 10 a quarter earlier. But it is likely to be only a small correction of the USD/JPY pair to the south.

Overall, most analysts (60%) remain bullish, expecting it to consolidate above the 110.00 horizon. The targets are 111.70 and 112.20. 100% of trend indicators and 75% of oscillators agree with this scenario. The remaining 25% give signals that the pair is overbought.

The remaining 40% of experts, supported by graphic analysis, still hope for a long-awaited correction to the south. At the same time, when moving to monthly and quarterly forecasts, their number increases to 75%. Support levels in case the pair falls are 109.00, 108.60, 108.40, 106.65. The target is zone 106.00;

- cryptocurrencies. It was noticed that not only plants start growing in the spring, but also bitcoin quotes. So, the BTC/USD pair rose in April by an average of 40% for the past three years. That is, this time it should be somewhere in the area of $70,000-75,000 by the end of April. Call options with expiration on April 30 show similar expectations. Those are now open at a price of $80,000 on derivative exchanges for a total of $240,000,000. Its active withdrawal to cold wallets continues in anticipation of a new growth cycle for the main cryptocurrency.

We have already talked more than once about the support package for the US economy in the amount of $1.9 trillion, of which, according to a study by Mizuho Securities, US citizens can spend $20-25 billion on the purchase of cryptocurrency. Following this anti-Covid package, another one is possible, in the amount of $3.0 trillion. And if adopted, it would also benefit the crypto market.

But all this is in the future. In the meantime, 60% of analysts believe that the BTC/USD pair will move along the Pivot Point of $50,000 for the next one or two weeks, fluctuating in the $46,500-56,000 range.

If we talk about a long-term forecast, according to the co-founder and former CEO of the BTCC cryptocurrency exchange Bobby Lee, the price of bitcoin can rise to $300,000, after which the growth will be replaced by a long-term decline. “Bitcoin bull market cycles occur every four years, and the current one is a big cycle. I think that bitcoin may rise to $100,000 this summer,” he said. However, after reaching an all-time high of $300,000, even a small price decrease will cause the bubble to collapse. Lee suggested that the new crypto winter will last between two and three years, and "investors should be prepared for the fact that the value of bitcoin could fall 80-90% from the historical peak."

And in conclusion of the review, we present you the next "miracle device" in our micro-heading "Crypto Life Hacks". WiseMining has recently introduced the Sato ASIC miner boiler that allows you to heat water by mining bitcoin. The intermediate coolant of the boiler is a special dielectric coolant. The liquid boils and evaporates in the ASIC cooling unit, the vapor rises into the tank coil and condenses, giving off heat to the water. Condensation flows back into the cooling unit of the miner. The developers provided the possibility of connecting this water heater to the main heating system of the room. Sato sales will begin as early as this April.

And one more "life hack", from the criminal world. According to a new study by analytical company Elliptic, the largest darknet market, Hydra, has a new way of exchanging cryptocurrency for fiat money. The vacuum-packed treasure with money is buried "5-20 cm underground", and the exact GPS coordinates are communicated to the buyer. This same method has long been used to sell illegal substances such as drugs. However, it is quite risky, as bandits sometimes track down customers and take away "the parcels". The consequences in this case are unpredictable.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.